dependent care fsa coverage

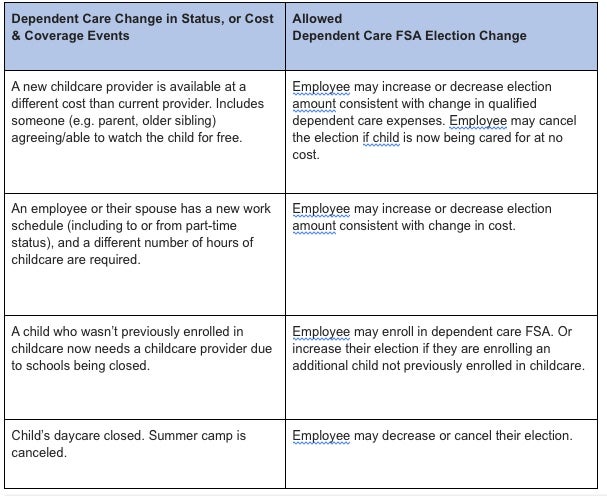

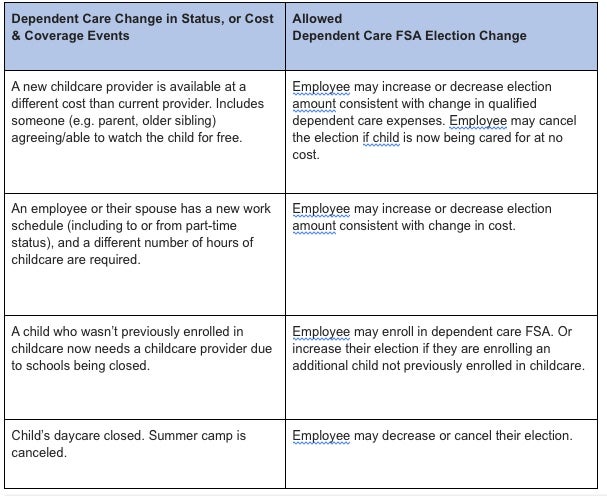

As determined by the IRS a change in status is an event that causes your dependent to meet or no longer meet eligibility requirements. Some subtypes have five tiers of coverage.

Message For 2020 Dependent Care Fsa Participants Office Of Faculty Staff Benefits Georgetown University

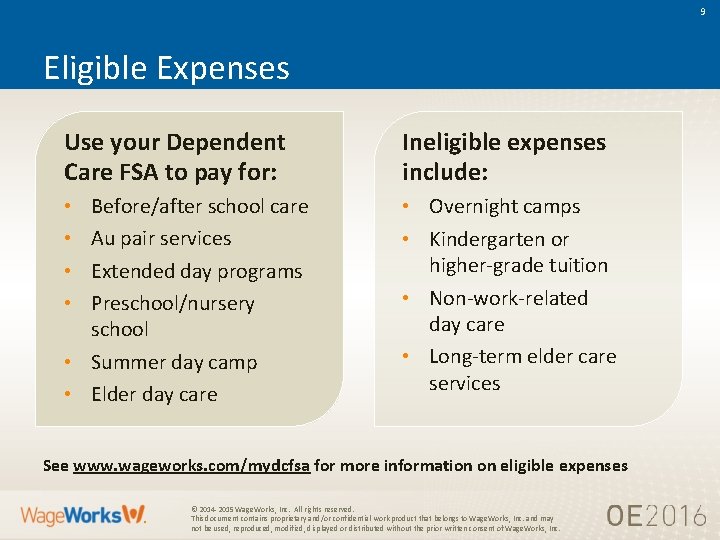

That money may help pay for a variety of eligible services including day care nursery school.

. There are over 100 participating businesses. Deductibles copays co-insurance health care provider visits prescription drugs over-the-counter items insulin diabetes syringes and. The amount you contribute to your take care by WageWorks Dependent Care FSA cannot be changed during the year unless you experience a change in status or a change in the cost or coverage of services.

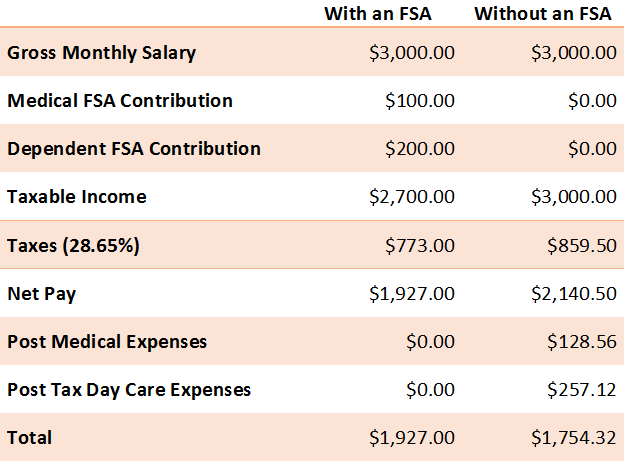

Employees set aside funds on a pretax basis to spend on qualifying dependent care expenses throughout the plan year. For this reason things like marriage counseling or couples therapy are not eligible for FSA and HSA coverage. The Penn State Discounts program is a collaborative effort between Penn State and local businesses with the primary goal of supporting the local economy by providing an extra benefit for being affiliated with Penn State University.

It will show you whether a drug is covered or not covered but the tier. The IRS determines which expenses are eligible for reimbursement. The treatment provided by a psychologist or psychiatrist is eligible for FSA or HSA reimbursement if the purpose of the treatment is for medical care and not for the general improvement of mental health.

As a result of COVID-19 participating employees are more likely to have unused health FSA amounts or dependent care assistance program amounts at the end of 2020 and 2021. Your account is funded by payroll deductions before taxes. A Dependent Care FSA is an Internal Revenue Code IRC 129 account that allows a participant to set aside up to a defined plan limit see our Plan Limits page per calendar year on a pre-tax basis to pay for qualified dependent care expenses.

Others have four tiers three tiers or two tiers. Qualified dependent care expenses must meet the following criteria. The American Rescue Plan Act of 2021 was enacted on March 11 2021 making the Child and Dependent Care credit substantially more generous and potentially refundableup to 4000 for one qualifying person and 8000 for two or more qualifying persons only for the tax year 2021 This means an eligible taxpayer can receive this credit even if they owe no federal income tax.

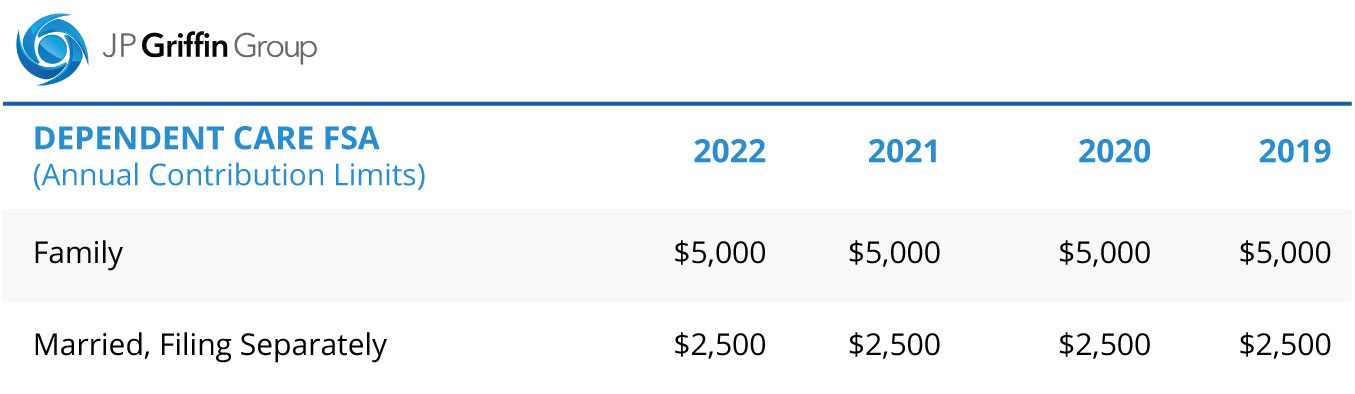

This search will use the five-tier subtype. A dependent care flexible spending account FSA can help you put aside dollars income tax-free for the care of children under 13 or for dependent adults who cant care for themselves. Flexible Spending Accounts FSA Health Care and Dependent Care.

Generally under these plans an employer allows its employees to set aside a certain amount of pre-tax wages to pay for medical care and dependent care expenses. You can use your Limited-Purpose FSA to pay for a variety of dental and vision care products and services for you your spouse and your dependents. Incurred during the period of.

Dependent-care Flexible Spending Accounts FSA let employees use tax-exempt funds to pay for childcare expenses they incur while at work. Footnote 2 Youll want to add up your total health care expenses per year. Employers save on payroll taxes for every dollar of employee participation often enough to cover the plans cost.

Your deductions will start the month after the election is made and you are eligible to use health care FSA contributions as of the effective date of coverage. You can change your contributions or enroll in an FSA due to a qualifying life event. Dependent Care Flexible Spending Account FSA.

A Dependent Care Flexible Spending Account DCFSA provides significant savings to employees and employers alike. But HSA holders can contribute to an LPFSA for dental and vision expenses and to a Dependent Care FSA for child care costs. Eligibility may vary depending on whether you are a Penn State employee student retiree or alum.

Fsa Tutorials Flexible Benefit Service Llc

Enrollment Information 24hourflex

Dependent Care Fsa Dcfsa Optum Financial

Dependent Care Flexible Spending Account

Flexible Spending Accounts Ensign Benefits

How A Dependent Care Fsa Can Enhance Your Benefits Package

How To File A Dependent Care Fsa Claim 24hourflex

Health Care And Dependent Care Fsas Infographic Optum Financial

The Benefits Of Offering Employees A Dependent Care Fsa Er

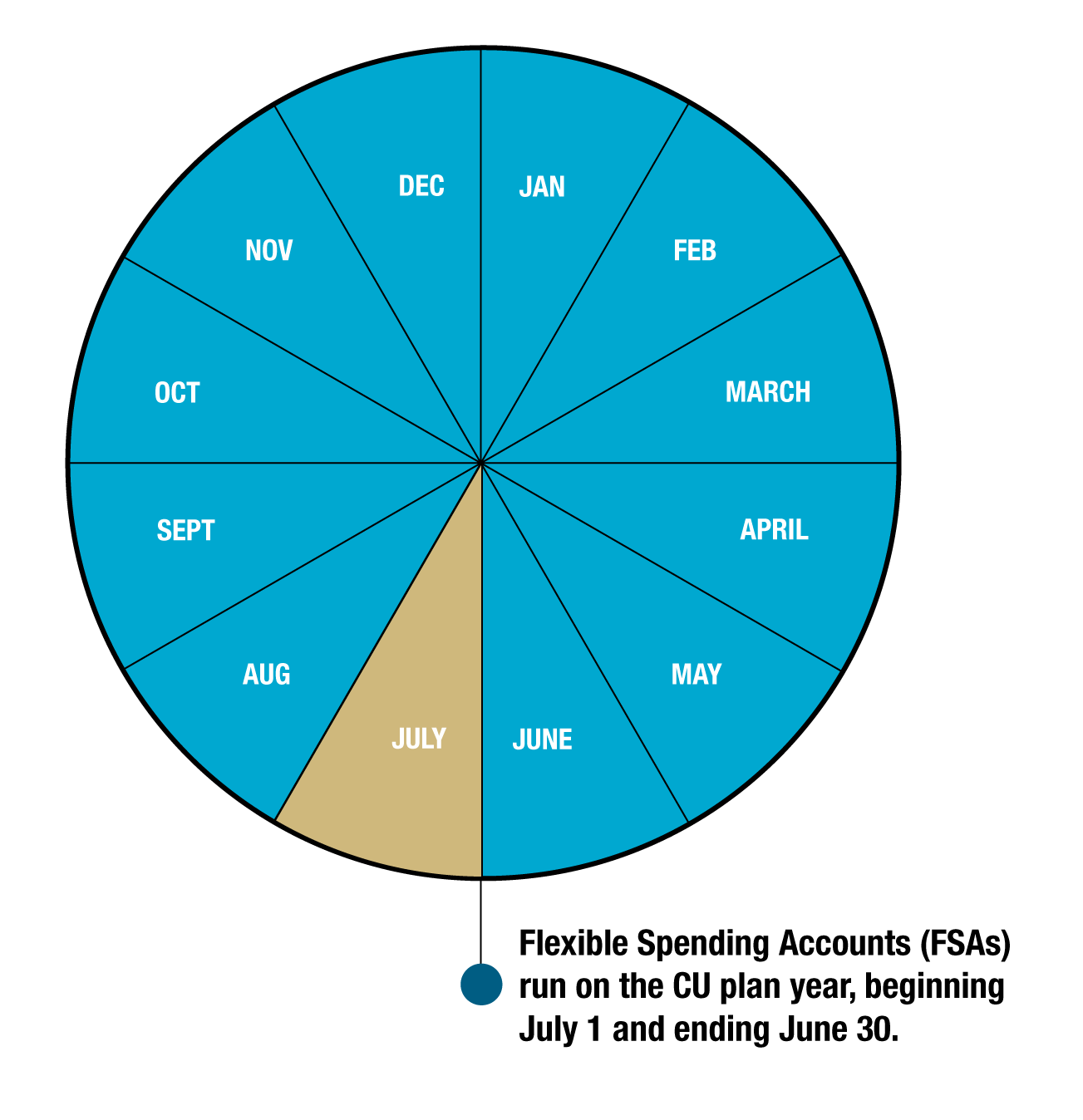

Dependent Care Fsa University Of Colorado

How To File A Dependent Care Fsa Claim 24hourflex

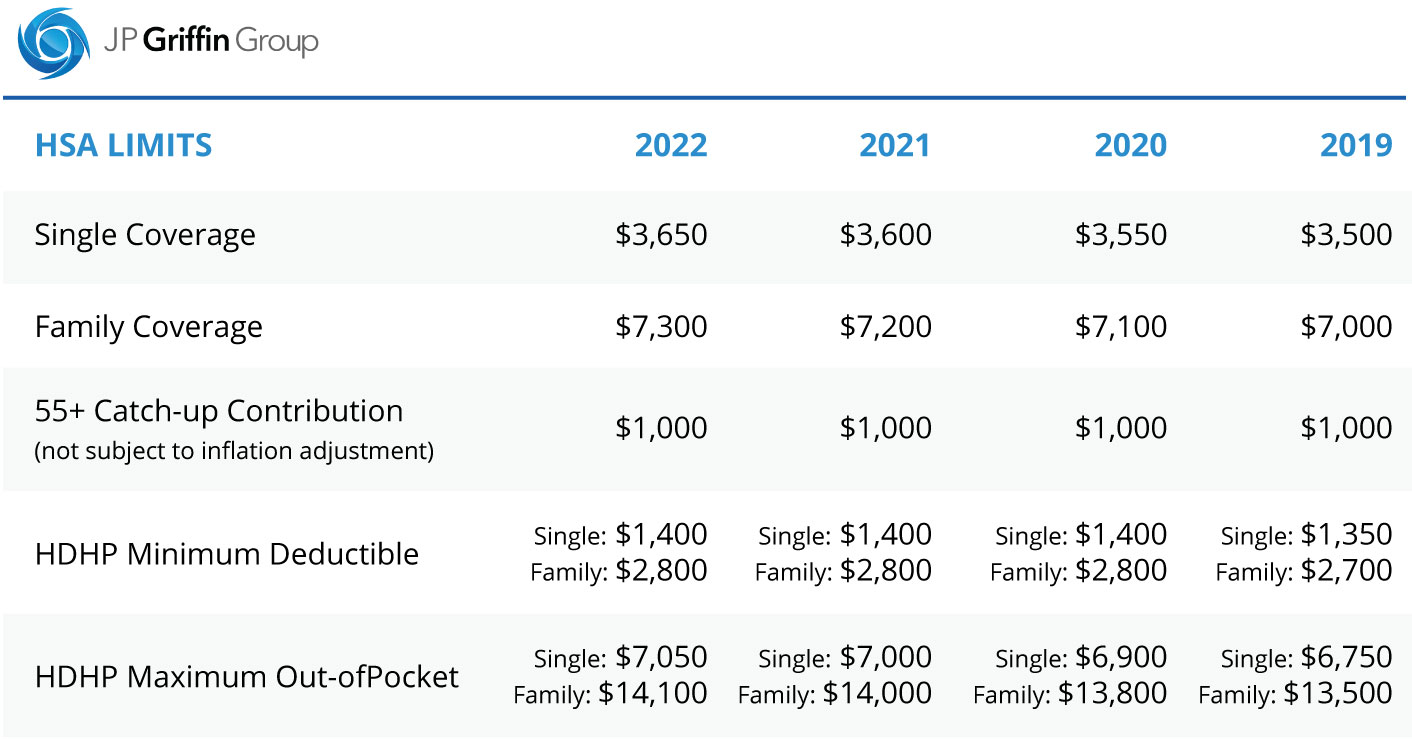

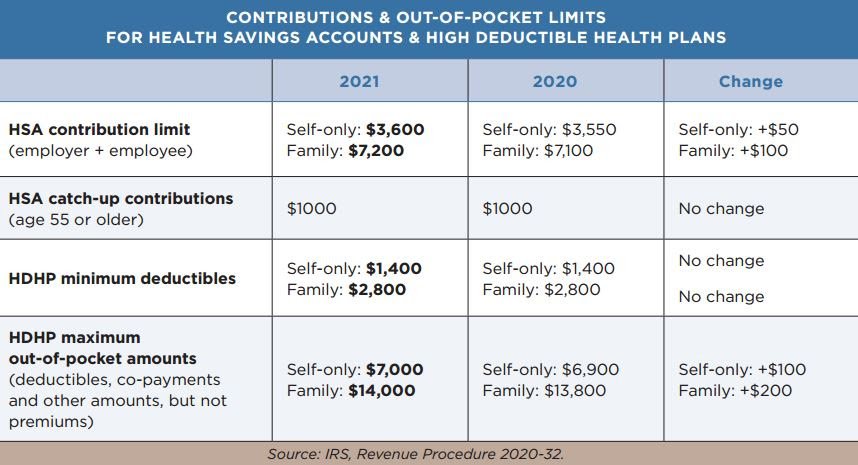

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Sterling Administration Year End Hsa And Fsa Tips And Reminders Claremont Insurance Services

Why You Should Consider A Dependent Care Fsa

1 Dependent Care Fsa Flexible Spending Account Presenter

New 2022 Brochure For Dependent Care Assistance Plan Fsa Benefit Plan Document Core Documents